Entering the world of foreign exchange (forex) trading can feel like learning a new language. Among the first and most important terms you’ll encounter is “PIP.” Understanding what a pip is in forex trading is fundamental to your success as a trader, as it forms the basis of how profits, losses, and risk are measured in the market.

Forex trading involves exchanging one currency for another, with traders making profits from the fluctuations in exchange rates between currency pairs. These fluctuations are measured in pips, making them the building blocks of forex trading analysis and strategy development.

This comprehensive guide will break down everything you need to know about pips in forex trading, from basic definitions to practical applications, ensuring you have a solid foundation for your trading journey.

The Definition of PIP

What Does PIP Stand For?

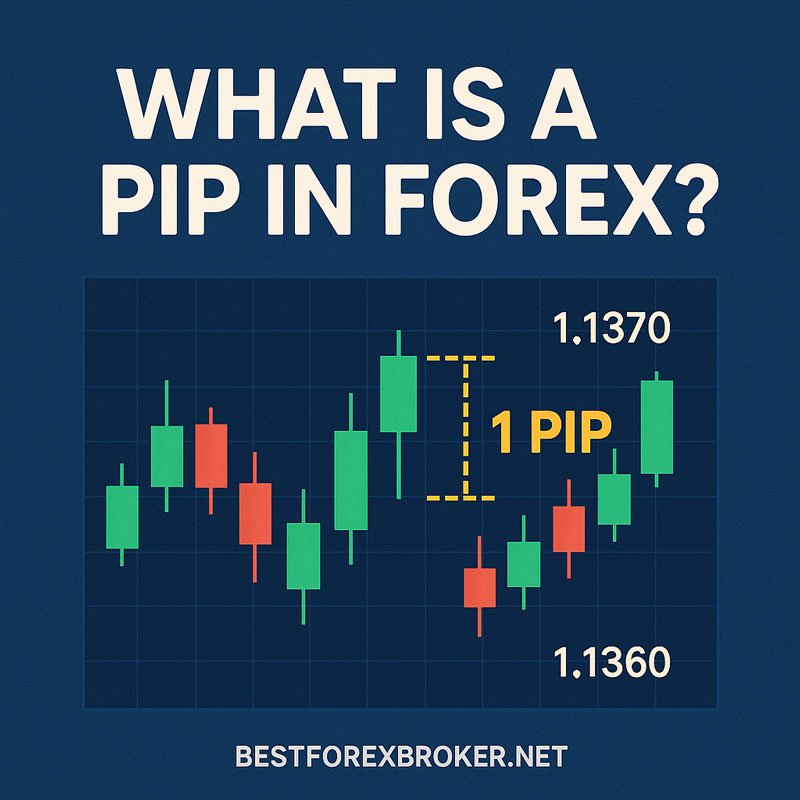

PIP stands for “Price Interest Point” or “Percentage in Point.” It represents the smallest standardized price movement in a forex currency pair.

For most currency pairs, a pip equals 0.0001 (or 1/10,000) of a unit. This fourth decimal place is the standard measurement for changes in a currency pair’s exchange rate.

For example, if the EUR/USD pair moves from 1.1050 to 1.1051, that’s a one-pip movement. This standardization helps traders communicate price movements clearly and consistently across the global forex market.

Standard PIP Values in Major Currency Pairs

For most major currency pairs (like EUR/USD, GBP/USD, AUD/USD), a pip is the fourth decimal place (0.0001). However, there are exceptions:

- Japanese Yen (JPY) pairs: Since the yen has a much lower value per unit, currency pairs involving JPY use the second decimal place as a pip. For instance, if USD/JPY moves from 153.45 to 153.46, that’s a one-pip movement.

- Some exotic currency pairs: Depending on the value and convention, some exotic pairs might also use different decimal places to define a pip.

Introduction to Pipettes/Fractional PIPs

Modern trading platforms often display currency pair prices to five decimal places (or three for JPY pairs). The fifth decimal place (or third for JPY) represents a fraction of a pip, commonly called a “pipette” or “fractional pip.” A pipette equals 1/10 of a standard pip.

For example, a move from 1.10501 to 1.10511 in EUR/USD represents a one-pip movement, with the last digit representing the pipette.

How PIPs Work in Forex Trading

Visual Examples of PIPs in Different Currency Pairs

To better understand pips, let’s examine how they appear in various currency pairs:

- EUR/USD: If the price moves from 1.0925 to 1.0935, that’s a 10-pip movement.

- USD/JPY: If the price changes from 153.45 to 154.45, that’s a 100-pip movement.

- GBP/USD: If the price shifts from 1.2650 to 1.2660, that’s a 10-pip movement.

How to Identify PIPs on Forex Charts

When looking at forex charts, you’ll notice that the price movements are displayed in pips. Depending on the timeframe and chart type, you might see:

- Candlestick charts: Each candle shows the opening, closing, high, and low prices for a specific period, with the vertical distance representing pip movements.

- Line charts: The line connects closing prices, with each point along the line representing a price in pips.

- Bar charts: Similar to candlestick charts, each bar shows the trading range in pips for a given period.

Your trading platform will typically allow you to hover over the chart to display the exact pip value at any point.

The Difference Between PIPs in 4-Decimal and 2-Decimal Currency Pairs

As mentioned earlier, most currency pairs quote to four decimal places, with the fourth decimal place representing one pip. However, currency pairs involving the Japanese yen typically quote to two decimal places, with the second decimal place representing one pip.

This difference is crucial to understand because it affects how you calculate profits, losses, and risk in your trades.

Calculating the Value of PIPs

Basic Formula for Calculating PIP Value

The monetary value of a pip varies depending on:

- The currency pair you’re trading

- Your position size (lot size)

- The base currency of your trading account

The basic formula for calculating the value of a pip is:

Pip Value = (Pip in decimal form × Lot Size) ÷ Exchange Rate

For currency pairs where USD is the quote currency (second currency in the pair), the formula simplifies to:

Pip Value = Pip in decimal form × Lot Size

Step-by-Step Examples Using Major Currency Pairs

Let’s calculate the pip value for different currency pairs with a standard lot (100,000 units):

Example 1: EUR/USD

- For EUR/USD at 1.1050

- One pip = 0.0001

- Standard lot = 100,000 units

- Pip value = 0.0001 × 100,000 = $10 per pip

Example 2: USD/JPY

- For USD/JPY at 153.50

- One pip = 0.01

- Standard lot = 100,000 units

- Pip value = (0.01 × 100,000) ÷ 153.50 ≈ $6.51 per pip

Example 3: GBP/USD

- For GBP/USD at 1.2650

- One pip = 0.0001

- Standard lot = 100,000 units

- Pip value = 0.0001 × 100,000 = $10 per pip

How Lot Size Affects PIP Value

The lot size you trade directly impacts the monetary value of each pip:

- Standard lot (100,000 units): Approximately $10 per pip for pairs with USD as the quote currency

- Mini lot (10,000 units): Approximately $1 per pip

- Micro lot (1,000 units): Approximately $0.10 per pip

- Nano lot (100 units): Approximately $0.01 per pip

This scalability allows traders with various account sizes to participate in the forex market while managing their risk appropriately.

Using PIP Calculators for Beginners

If these calculations seem complex, don’t worry. Most trading platforms offer built-in pip calculators, and there are numerous free online calculators available. These tools instantly compute pip values based on your currency pair, lot size, and account currency, making the process seamless for beginners.

Read me: Learn more about forex trading tools for beginners

The Significance of PIPs in Trading

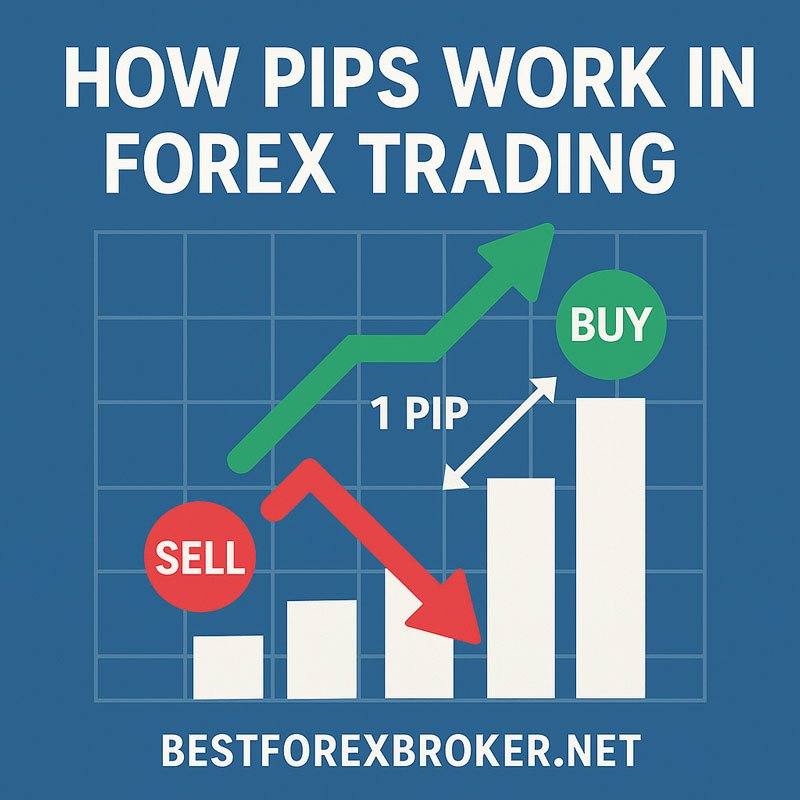

How PIPs Measure Profit and Loss

PIPs form the foundation of profit and loss calculation in forex trading. When you enter a trade, the difference between your entry and exit prices, measured in pips, determines your profit or loss.

For example, if you buy 1 standard lot of EUR/USD at 1.1050 and sell at 1.1070:

- The price moved 20 pips in your favor

- With a pip value of $10, your profit would be 20 × $10 = $200

Conversely, if the price moved against you by 20 pips, you would incur a $200 loss.

Using PIPs to Set Stop-Loss and Take-Profit Levels

PIPs are instrumental in setting precise risk management parameters:

- Stop-loss orders: These limit potential losses by automatically closing a position when the price moves against you by a specified number of pips. For example, setting a 30-pip stop-loss on a EUR/USD trade means your position will automatically close if the price moves 30 pips against you.

- Take-profit orders: These secure profits by automatically closing a position when it reaches a target number of pips in your favor. A 50-pip take-profit order would close your trade once it gains 50 pips.

Setting these levels in pips rather than dollar amounts ensures your risk management strategy remains consistent regardless of the currency pair or lot size.

Read me: Explore effective stop-loss strategies in forex

PIPs in Spread Calculations

The spread is the difference between the bid price (selling price) and the ask price (buying price) of a currency pair, also measured in pips. For example, if EUR/USD has a bid price of 1.1050 and an ask price of 1.1052, the spread is 2 pips.

The spread represents the transaction cost paid to the broker for facilitating your trade. Lower spreads mean lower trading costs, which is why many traders seek brokers offering competitive pip spreads.

How Brokers Make Money Through PIPs

Brokers primarily generate revenue through spreads. When you execute a trade, you pay the spread, which goes to the broker as compensation for their services. Some brokers offer fixed spreads, while others provide variable spreads that fluctuate based on market conditions.

Understanding how spreads work is crucial for calculating your true trading costs and selecting the right broker for your trading style.

Read me: How to choose the right forex broker for your trading needs

PIPs and Risk Management

Using PIPs to Quantify Risk

PIPs provide a standardized way to quantify risk in forex trading. Rather than thinking in dollar terms (which can vary based on lot size and currency pair), thinking in pips offers a consistent measure of market movement.

For example, saying “I’m risking 50 pips on this trade” provides a clear picture of your risk tolerance, regardless of the specific currency pair or position size.

The 1-2% Risk Rule in Terms of PIPs

A common risk management principle in forex is the 1-2% rule, which suggests risking no more than 1-2% of your trading capital on a single trade. You can translate this percentage into pip terms:

For instance, if you have a $10,000 account and want to risk 1% ($100) on a trade:

- Trading EUR/USD with a pip value of $10 per standard lot

- Maximum risk = 10 pips per standard lot ($100 ÷ $10)

- Alternatively, you could trade a smaller lot size to accommodate a wider stop-loss in pips

Position Sizing Based on PIP Risk

Understanding pips allows for precise position sizing based on your risk tolerance:

Position Size = Risk Amount ÷ (Stop-Loss in Pips × Pip Value)

For example, if you want to risk $100 on a trade with a 50-pip stop-loss in EUR/USD (where 1 pip = $10 for a standard lot):

Position Size = $100 ÷ (50 pips × $10) = 0.2 lots

This calculation ensures that regardless of the currency pair or stop-loss distance, your actual dollar risk remains controlled.

Practical Examples of Risk Management Using PIPs

Let’s look at how pip-based risk management works in practice:

Scenario: Trading GBP/USD with a $5,000 account

- Risk tolerance: 2% of account ($100)

- Stop-loss distance: 40 pips

- Pip value for standard lot: $10

Calculation:

- Maximum position size = $100 ÷ (40 × $10) = 0.25 lots

This approach ensures your risk remains proportional to your account size while adapting to market conditions.

Read me: Advanced risk management strategies for forex traders

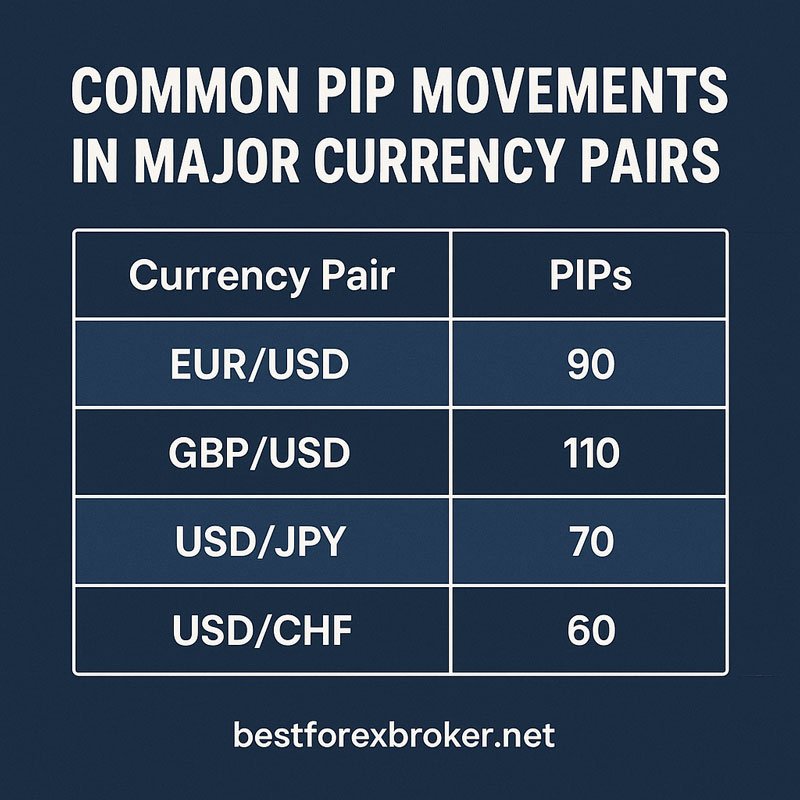

Common PIP Movements in Major Currency Pairs

Average Daily PIP Movements in Popular Pairs

Understanding the typical pip range of currency pairs helps set realistic expectations and appropriate stop-loss and take-profit levels:

- EUR/USD: Average daily range of 70-100 pips

- GBP/USD: Average daily range of 100-150 pips

- USD/JPY: Average daily range of 70-90 pips

- AUD/USD: Average daily range of 60-90 pips

These ranges vary based on market conditions and can expand significantly during high-impact news events.

Volatility and Its Effect on PIP Movements

Volatility refers to the rate at which a currency pair’s price increases or decreases. Higher volatility means larger pip movements in shorter timeframes, presenting both greater risk and potential reward.

Some currency pairs, like GBP/USD and AUD/USD, are naturally more volatile, while others, like EUR/USD, tend to be more stable. Understanding these characteristics helps you choose currency pairs that match your risk tolerance and trading style.

Economic Events That Cause Significant PIP Changes

Certain economic announcements and events can trigger substantial pip movements:

- Central bank interest rate decisions

- Employment reports (like the U.S. Non-Farm Payrolls)

- Inflation data releases

- GDP reports

- Political events and elections

During these events, currency pairs can move hundreds of pips in minutes, creating opportunities for event-based traders but posing risks for those unprepared for the volatility.

Read me: How to trade during major economic news releases

Practical Tips for New Traders

How to Think in PIPs Rather Than Currency

One of the most important mindset shifts for new forex traders is thinking in pips rather than dollar amounts. This approach offers several advantages:

- It provides a standardized way to evaluate trades across different currency pairs

- It helps maintain emotional detachment from monetary gains and losses

- It facilitates more objective analysis of trading performance

Rather than celebrating a $200 profit, thinking “I captured 20 pips” focuses your attention on the quality of your trading decisions rather than the monetary outcome.

Common Mistakes Beginners Make Regarding PIPs

New traders often fall into these pitfalls when dealing with pips:

- Confusing pips with points or ticks: Make sure you understand the difference between these terms in your specific trading platform.

- Ignoring the different pip values across currency pairs: Remember that a 20-pip move in EUR/USD represents a different monetary value than a 20-pip move in USD/JPY.

- Setting unrealistic pip targets: Aiming for 100+ pips daily ignores market realities and often leads to overtrading or excessive risk-taking.

- Neglecting to adjust position size based on pip risk: Trading the same lot size across all currency pairs without accounting for different pip values can lead to inconsistent risk exposure.

Tools to Help Track and Calculate PIPs

Several tools can assist you in managing pips effectively:

- Pip calculators: These determine the monetary value of a pip based on your lot size and currency pair.

- Position size calculators: These help determine the appropriate lot size based on your account size, risk percentage, and stop-loss in pips.

- Economic calendars: These highlight upcoming events that might cause significant pip movements.

- Currency strength meters: These indicate which currencies are strong or weak, potentially leading to substantial pip movements in related pairs.

Conclusion

Understanding what a pip is in forex trading is more than just learning terminology—it’s about mastering the fundamental unit of measurement that underlies all forex trading activities. Pips are essential for:

- Accurately measuring price movements

- Calculating profits and losses

- Implementing effective risk management strategies

- Setting realistic trading goals

- Communicating precisely with other traders

As you continue your forex trading journey, maintaining a pip-centric approach will help you develop a more disciplined, systematic, and ultimately successful trading strategy. Remember that consistent pip gains, regardless of their size, compound over time to generate significant returns.

The forex market offers abundant opportunities, but success requires patience, education, and proper risk management—all facilitated by a solid understanding of pips and their application in real-world trading scenarios.

Next steps: Learn about forex trading strategies for beginners

Frequently Asked Questions (FAQ)

What is the difference between a pip and a pipette?

A pip is the standard unit of measurement for currency price movements, typically the fourth decimal place (0.0001) for most pairs or the second decimal place (0.01) for JPY pairs. A pipette is 1/10 of a pip, represented by the fifth decimal place (0.00001) or third decimal place (0.001) for JPY pairs.

How much money do I make per pip?

The money you make per pip depends on your lot size and the currency pair you’re trading. For standard lots (100,000 units) in pairs with USD as the quote currency, each pip is worth approximately $10. For mini lots (10,000 units), it’s about $1 per pip, and for micro lots (1,000 units), it’s roughly $0.10 per pip.

Why are pips important in forex trading?

Pips are essential because they provide a standardized way to measure price movements, calculate profits and losses, determine position sizes, set stop-loss and take-profit levels, and implement consistent risk management strategies across different currency pairs.

Do all forex brokers calculate pips the same way?

Most brokers follow the standard convention of four decimal places for most currency pairs and two for JPY pairs. However, some might display prices differently or offer variable pip spreads versus fixed spreads, which can affect your trading costs.

How many pips should I aim for in a day?

There’s no one-size-fits-all answer, as achievable pip targets depend on your trading style, the currency pairs you trade, market conditions, and risk tolerance. Rather than focusing on a specific pip target, concentrate on making quality trades with favorable risk-to-reward ratios.

What’s a good pip spread?

Spread quality varies by currency pair, market conditions, and broker type. Major pairs like EUR/USD typically have tighter spreads (1-3 pips) during normal market hours, while exotic pairs may have wider spreads. Generally, lower spreads mean lower trading costs, but other factors like execution quality also matter.

How do I convert pips to dollars?

To convert pips to dollars, multiply the number of pips by the pip value for your specific lot size and currency pair. For example, if you’re trading 0.1 lots (mini lot) of EUR/USD where 1 pip = $1 for a mini lot, then 20 pips would equal $20.

Can pip values change over time?

Yes, the monetary value of a pip can change based on exchange rate fluctuations, particularly for currency pairs where neither currency is your account base currency. However, these changes are typically minimal for most trading purposes.