The Moving Average Convergence Divergence (MACD) is one of the most popular technical indicators used by forex traders to identify trends and potential trading opportunities. If you’re new to forex trading, the MACD can seem intimidating, but it’s a powerful yet simple tool when understood correctly. This guide will walk you through how to use the MACD indicator step-by-step, ensuring you can apply it confidently to your trading strategy.

What Is the MACD Indicator?

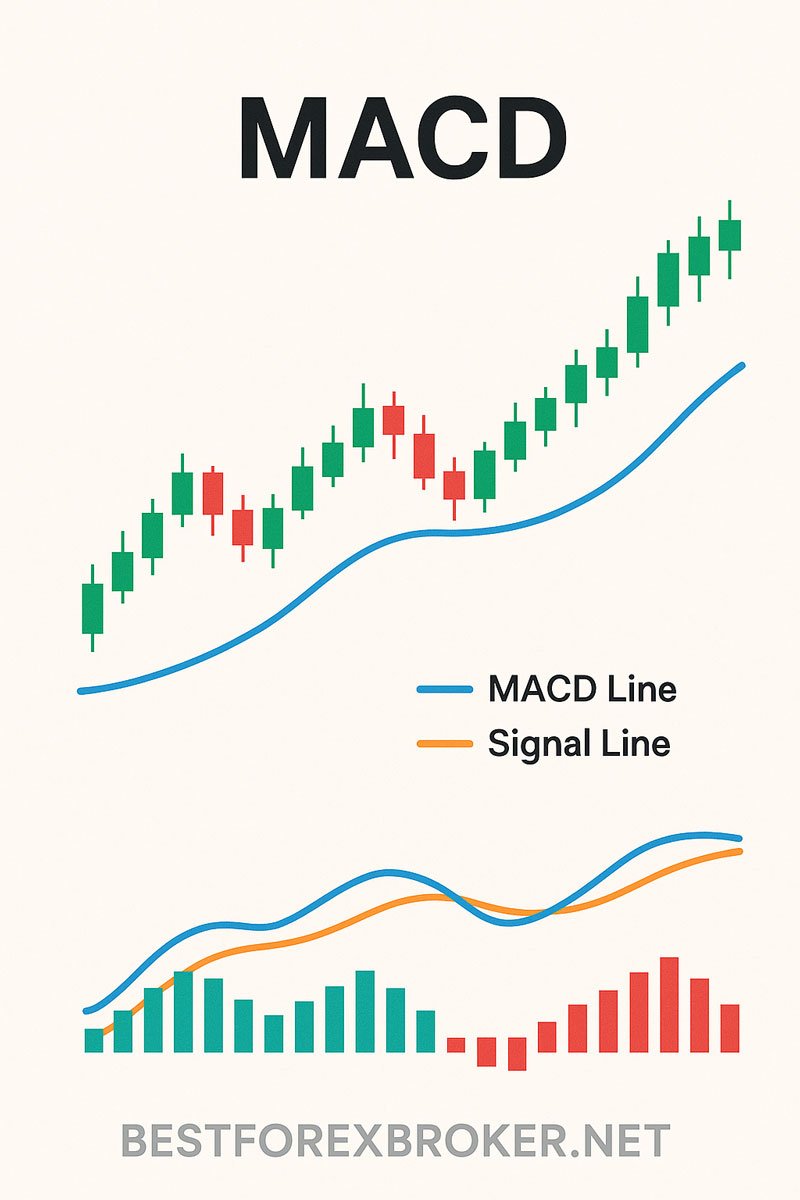

The MACD is a trend-following momentum indicator that helps traders identify the direction and strength of a market trend. It consists of three main components:

- MACD Line: Calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. This line shows the relationship between two moving averages.

- Signal Line: A 9-period EMA of the MACD line. Crossovers between the MACD line and signal line often signal buy or sell opportunities.

- Histogram: The difference between the MACD line and the signal line, visually representing momentum.

Why is this important? Understanding these components will help you interpret MACD signals accurately and avoid common trading mistakes.

Why Use MACD for Forex Trading?

MACD is beginner-friendly because it:

- Identifies trends and reversals.

- Provides clear buy and sell signals.

- Works across multiple timeframes (e.g., 1-hour, 4-hour, daily charts).

- Combines momentum and trend analysis for better decision-making.

However, MACD is not a standalone tool. Always combine it with other indicators, like support and resistance levels or RSI, to confirm signals and reduce risks.

Step-by-Step Guide to Trading with MACD

Follow these steps to start trading forex basic using the MACD indicator:

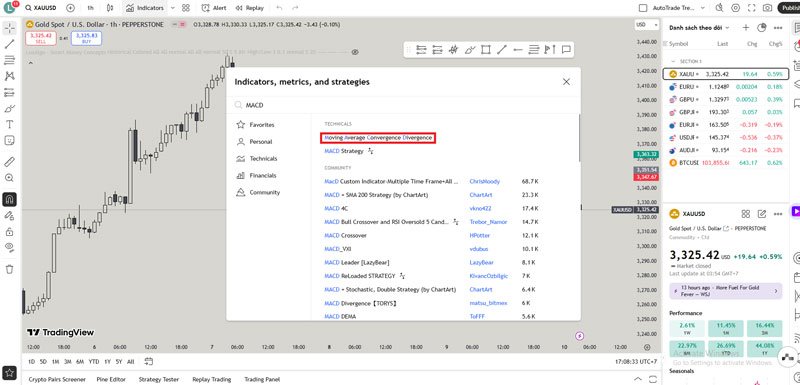

Step 1: Set Up Your Chart

- Open your trading platform (e.g., MetaTrader 4 or 5).

- Select a currency pair (e.g., EUR/USD) and a timeframe (e.g., 1-hour chart for beginners).

- Add the MACD indicator from your platform’s indicator menu. Use default settings (12, 26, 9) for simplicity.

Step 2: Understand MACD Signals

The MACD generates three primary signals:

-

Crossover Signals:

- Bullish Crossover: When the MACD line crosses above the signal line, it suggests a potential buy opportunity.

- Bearish Crossover: When the MACD line crosses below the signal line, it indicates a potential sell opportunity.

-

Zero Line Crossovers:

- When the MACD line crosses above the zero line, it signals a bullish trend.

- When it crosses below the zero line, it signals a bearish trend.

-

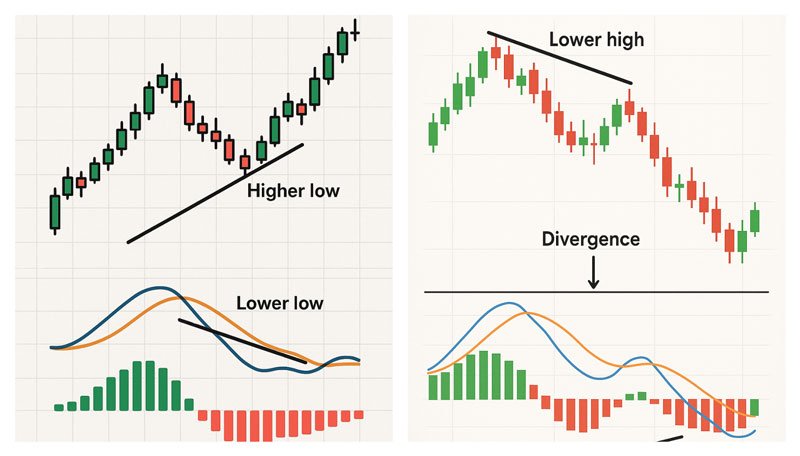

Divergence:

- Bullish Divergence: When the price makes lower lows, but the MACD makes higher lows, it suggests a potential reversal upward.

- Bearish Divergence: When the price makes higher highs, but the MACD makes lower highs, it indicates a potential reversal downward.

Key takeaway: Crossovers are the easiest signals for beginners, but divergences require more experience to interpret accurately.

Step 3: Develop a Trading Strategy

Here’s a simple MACD trading strategy for beginners:

- Wait for a crossover: Look for a bullish crossover (MACD line above signal line) for a buy or a bearish crossover for a sell.

- Confirm the trend: Ensure the MACD is above the zero line for buys or below for sells.

- Check other indicators: Use support/resistance levels or RSI to confirm the signal.

- Set stop-loss and take-profit:

- Place a stop-loss below recent support (for buys) or above resistance (for sells).

- Aim for a risk-to-reward ratio of at least 1:2.

Example: On a 1-hour EUR/USD chart, if the MACD line crosses above the signal line and the histogram turns positive, enter a buy trade. Set a stop-loss 20 pips below the recent low and a take-profit 40 pips above.

Step 4: Practice on a Demo Account

Before risking real money, practice your MACD strategy on a demo account. This helps you:

- Get familiar with MACD signals.

- Test different timeframes and currency pairs.

- Build confidence without financial risk.

Trade with a trusted broker today

See for yourself why Exness is the broker of choice for over 1 million traders and 100,000 partners.

Step 5: Manage Your Risk

Risk management is critical in forex trading. Follow these rules:

- Never risk more than 1-2% of your account on a single trade.

- Avoid overtrading by sticking to high-probability setups.

- Use a trading journal to track your trades and learn from mistakes.

Common Mistakes to Avoid

- Ignoring the trend: MACD works best in trending markets. Avoid using it in choppy, sideways markets.

- Relying only on MACD: Always confirm signals with other tools or price action.

- Overcomplicating the strategy: Stick to simple crossover signals as a beginner.

- Neglecting risk management: Failing to set stop-losses can lead to significant losses.

Tips for Success with MACD

- Start with higher timeframes (e.g., 4-hour or daily charts) to reduce noise and false signals.

- Combine MACD with price action techniques, such as candlestick patterns.

- Regularly review your trades to identify patterns and improve your strategy.

- Stay patient—MACD signals take time to develop, so avoid rushing into trades.

The MACD indicator is a versatile and beginner-friendly tool for forex trading systems. By mastering its signals, combining it with other indicators, and practicing disciplined risk management, you can improve your trading performance. Start small, practice consistently, and always prioritize learning. Ready to try MACD? Open a demo account today and test this strategy on your favorite currency pair!

FAQ: Trading with MACD for Beginners

What is the best timeframe for using MACD?

For beginners, the 1-hour or 4-hour chart is ideal as it balances signal frequency and reliability. Higher timeframes like the daily chart are great for long-term trades.

Can I use MACD for scalping?

Yes, but scalping requires lower timeframes (e.g., 5-minute charts) and faster decision-making. Beginners should avoid scalping until they’re comfortable with MACD signals.

Does MACD work for all currency pairs?

MACD works across all currency pairs, but it performs best on highly liquid pairs like EUR/USD or USD/JPY due to their clear trends and lower spreads.

How do I avoid false MACD signals?

Combine MACD with other indicators (e.g., RSI, moving averages) and price action. Avoid trading in choppy markets, and always confirm signals with the overall trend.

Is MACD enough to trade profitably?

No single indicator guarantees profits. MACD is a great starting point, but successful trading requires a combination of indicators, risk management, and market analysis.