In the world of forex trading, risk management is not just an optional strategy — it’s the foundation of success. Many traders enter the forex market with hopes of quick profits, only to lose their investments due to poor risk control.

Forex risk management refers to the techniques and tools traders use to minimize and control the risks involved in currency trading. Its goal is simple yet powerful: protect your trading account from significant losses while maximizing potential gains.

💡 Did you know? Over 90% of retail forex traders lose money, and one of the biggest reasons is inadequate risk management.

Without proper planning, even the most technically sound trading strategy can fail. In this guide, we’ll walk you through the essential principles of forex risk management so you can trade confidently and sustainably.

Why Risk Management Matters More Than Profit Strategy

While many traders focus on finding the perfect entry or exit point, true success in forex comes from how well you manage your risk .

Think of it like this: If you have $10,000 in your trading account and lose 50%, you’ll need to gain 100% just to break even. That’s why preserving capital should always be your top priority .

A strong profit strategy may help you win individual trades, but without solid risk controls, those wins won’t last long. Effective risk management ensures that a few losing trades don’t wipe out your account.

Common Risks in Forex Trading

Before diving into strategies, let’s understand the main types of risks you might face as a forex trader:

🔹 Market Risk

Also known as systematic risk, this involves fluctuations in currency prices due to economic events, geopolitical issues, or interest rate changes.

🔹 Leverage Risk

Using high leverage increases both potential profits and losses. One bad trade can trigger a margin call or total loss if leverage is misused.

🔹 Interest Rate Risk

Changes in central bank policies affect currency values. For example, if the U.S. Federal Reserve raises interest rates, the USD typically strengthens.

🔹 Broker Risk

Choosing an unregulated or unreliable broker can lead to slippage, manipulation, or even fraud.

🔹 Emotional Risk

Fear and greed often lead traders to make impulsive decisions. Discipline is crucial to avoid emotional trading mistakes.

Understanding these risks allows you to create a tailored plan to mitigate them.

Key Forex Risk Management Strategies

Let’s explore some of the most effective risk control strategies every trader should implement.

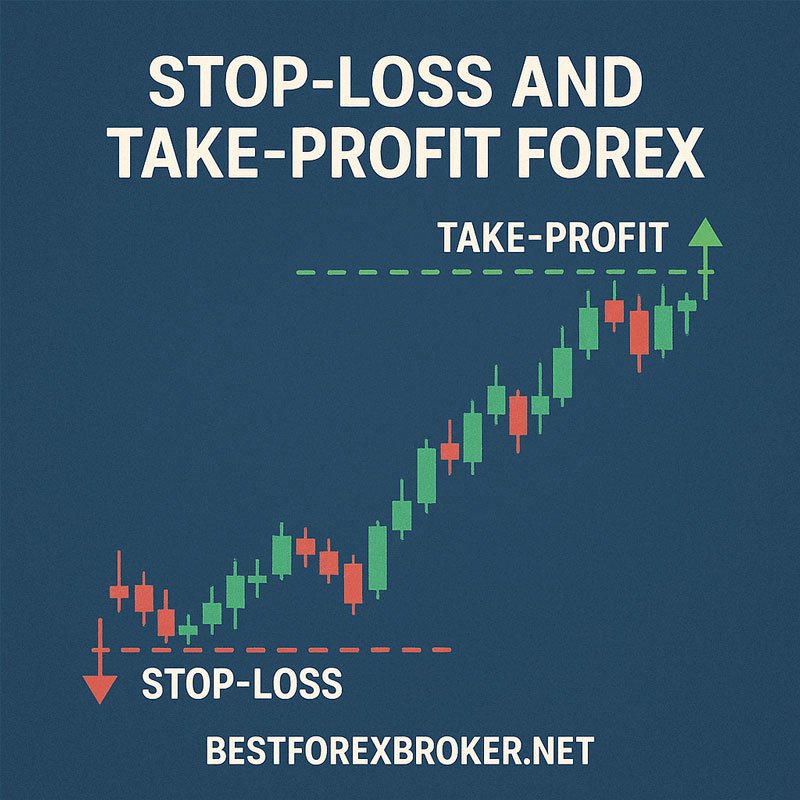

Setting Stop-Loss Orders

A stop-loss order automatically closes a trade when it reaches a certain loss level. This helps prevent catastrophic losses.

Types of Stop-Loss:

- Standard Stop-Loss : Triggers at a set price.

- Trailing Stop-Loss : Moves with the price to lock in gains.

- Guaranteed Stop-Loss : Ensures execution at the exact price (often offered by brokers for a fee).

📌 Best Practices:

- Place stop-losses based on technical levels (e.g., support/resistance).

- Avoid placing stops too close to the entry price.

- Never move a stop-loss further away after entering a trade.

Proper Position Sizing

Position sizing determines how much of a currency pair you buy or sell. It’s one of the most underrated yet powerful tools in risk management.

How to Calculate Position Size:

Use the 2% rule : Never risk more than 2% of your account on any single trade.

Example:

- Account size: $10,000

- Risk per trade: 2% = $200

- Stop-loss distance: 50 pips

- Pip value: $1 per pip

- Max lot size = 2 lots

Many platforms offer position sizing calculators to simplify this process.

Using Take-Profit Levels

Just as important as limiting losses is securing profits. A take-profit order locks in gains once the price hits your target.

Tips:

- Set realistic targets based on historical price movements.

- Use reward-to-risk ratios (e.g., aim for 2:1 or higher).

- Don’t move take-profit orders closer to the market once placed.

Limiting Leverage

Leverage allows you to control large positions with small capital — but it’s a double-edged sword.

📌 Recommended Leverage Ratios:

- Beginners: 10:1 or lower

- Experienced traders: Up to 50:1

- Professional traders: Often use no leverage or very low leverage

Remember: Higher leverage means higher risk.

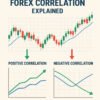

Diversifying Trades

Diversification reduces exposure to any single trade or market event.

Ways to Diversify:

- Trade multiple currency pairs (not all correlated).

- Mix short-term and long-term strategies.

- Consider trading different asset classes (e.g., stocks or commodities).

Avoid overloading your portfolio with correlated trades. For instance, EUR/USD and GBP/USD often move in the same direction.

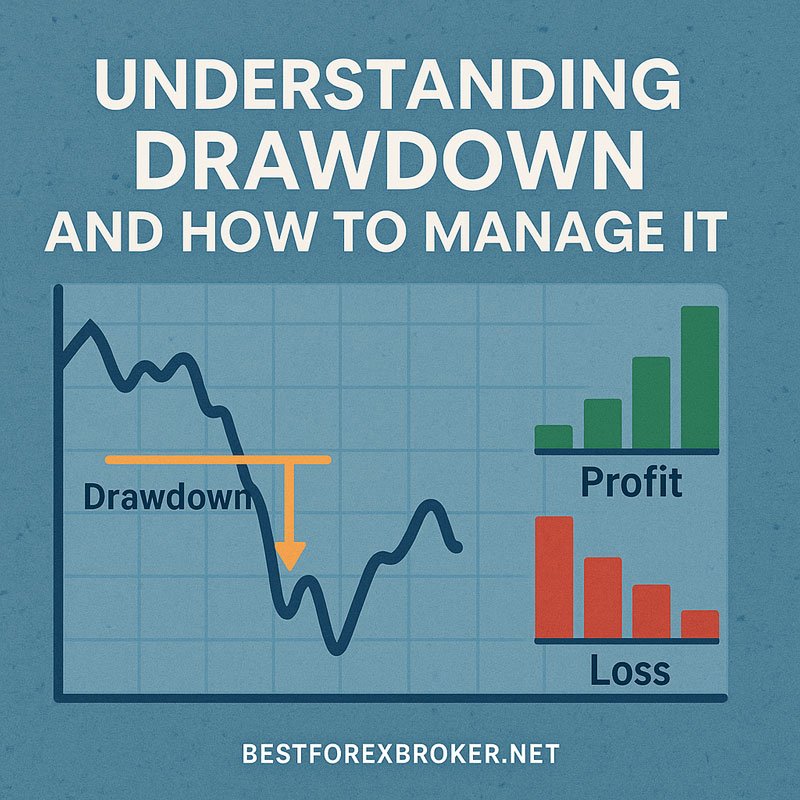

Understanding Drawdown and How to Manage It

Drawdown is the decline from a peak in your trading account balance. Managing drawdown is critical to staying in the game.

Acceptable vs. Dangerous Drawdown:

- Acceptable : 10–20% drawdown on a winning strategy.

- Dangerous : Anything above 30% can be difficult to recover from.

How to Recover Safely:

- Reduce position sizes during drawdowns.

- Review and refine your strategy.

- Take a break if emotions are clouding judgment.

📌 Pro Tip: Always know your maximum acceptable drawdown before starting to trade.

Psychological Risk Management

Even with the best strategies, emotional discipline separates successful traders from the rest.

Controlling Emotions:

- Fear leads to missed opportunities; greed leads to overtrading.

- Stick to your trading plan regardless of emotions.

Sticking to Your Trading Plan:

- Write down your rules and follow them strictly.

- Avoid making spontaneous trades based on news or social media hype.

Keeping a Trading Journal:

- Record each trade, including reasons for entry/exit and lessons learned.

- Regularly review your journal to identify patterns and areas for improvement.

Tools and Resources for Better Risk Control

Several tools can help streamline your risk management efforts:

| Risk Calculator | Helps determine trade size and risk per trade. | |

| Trading Platforms (MT4/MT5) | Offer built-in tools like stop-loss, take-profit, and alerts. | |

| Economic Calendar | Stay informed about upcoming market-moving events. | |

| Forex Brokers with Education Sections | Provide tutorials and webinars on risk practices. | |

📌 Recommended Reading:

- “Trading in the Zone” by Mark Douglas

- “The Disciplined Trader” by Mark Douglas

Real-Life Examples and Case Studies

Case Study 1: The Overleveraged Trader

John opened a $5,000 forex account and used 100:1 leverage. He entered a single trade without a stop-loss. When the market moved against him, he lost $4,000 overnight — 80% of his account.

👉 Lesson: High leverage without a stop-loss is extremely risky.

Case Study 2: The Disciplined Trader

Sarah followed the 2% rule, used proper stop-losses, and kept a trading journal. Even after several losses, she remained profitable over time because her winners outweighed her losers.

👉 Lesson: Consistency and discipline lead to long-term success.

Conclusion

Forex risk management isn’t just a set of rules — it’s a mindset. Whether you’re a beginner or an experienced trader, mastering these principles will significantly increase your chances of long-term success.

By implementing stop-losses, managing leverage, practicing proper position sizing, and maintaining emotional discipline, you’ll protect your capital and build a sustainable trading career.

✅ Final Thoughts

If you’re just starting out in the forex market, remember that success begins with risk control . No matter how good your strategy is, improper risk management will eventually lead to failure.

Start small, stay disciplined, and always prioritize protecting your capital. With time and consistency, you can become a confident and profitable forex trader.

❓ Frequently Asked Questions (FAQ)

What is forex risk management?

Forex risk management refers to the methods traders use to reduce and control the risks involved in foreign exchange trading. It includes setting stop-losses, using proper position sizing, and avoiding excessive leverage.

Why is risk management important in forex?

Because forex markets are highly volatile, a single poorly managed trade can wipe out your entire account. Good risk management protects your capital and improves long-term profitability.

How much should I risk per trade?

Most professional traders recommend risking no more than 1–2% of your account equity per trade . This helps ensure longevity in the market.

What is a stop-loss order?

A stop-loss order automatically closes a trade when it reaches a predetermined loss level. It helps limit losses and protect your account.

Can I trade forex without leverage?

Yes, many conservative traders choose to trade without leverage or use very low leverage (e.g., 1:1 or 2:1). This reduces risk but also limits potential returns.

How do I calculate my position size?

Use a position sizing calculator or apply the 2% rule: never risk more than 2% of your account on a single trade. Adjust the lot size accordingly based on your stop-loss.

Is forex trading risky for beginners?

Yes, forex trading carries significant risk, especially for those who lack knowledge of risk management. However, with proper education and practice, beginners can learn to trade safely and profitably.