With over 10 years in the forex industry, XM Broker has grown into one of the most recognized names among global traders. Established in 2009, XM serves clients in over 190 countries and is known for its wide range of account types, educational resources, and support for both beginners and professionals.

In this review, we explore XM’s features, regulations, trading conditions, platforms, and support services to help you decide if it’s the right choice for your trading needs in 2025. Whether you’re just starting out or managing multiple strategies, XM offers a flexible trading environment designed to support your growth.

👉 Let’s dive into the full analysis of what XM Broker has to offer.

- Regulated by multiple trusted authorities (FCA, ASIC, CySEC)

- Low minimum deposit ($5) for Micro and Standard accounts

- Free deposit/withdrawal and negative balance protection

- Strong educational support and demo environment

- Wide range of trading instruments and platforms

- Multiple account types for different trading styles

- No cryptocurrency trading available

- Share account has a high minimum deposit ($10,000)

- Does not support MT5 on all account types

- Bonus programs may vary by region due to regulations

Company Overview

XM is a global forex and CFD broker operated by Trading Point Holdings Ltd. The broker is regulated by several tier-1 and tier-2 authorities, including:

-

FCA (UK)

-

ASIC (Australia)

-

CySEC (Cyprus)

-

DFSA (UAE)

-

IFSC (Belize)

This multi-regulatory structure boosts transparency and trader protection, a key element for anyone seeking a secure trading experience.

XM offers trading on:

-

50+ Forex pairs

-

Commodities (gold, oil, etc.)

-

Stock indices

-

Shares CFDs

-

Precious metals

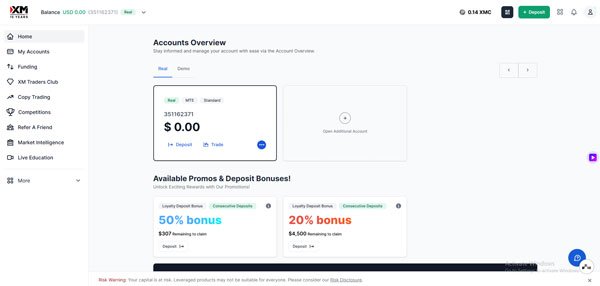

XM Trading Accounts

XM provides several account types to suit traders at every level:

| Account Type | Minimum Deposit | Spread (from) | Commission | Leverage (max) |

|---|---|---|---|---|

| Micro | $5 | 1.0 pip | None | 1:1000 |

| Standard | $5 | 1.0 pip | None | 1:1000 |

| Ultra Low | $50 | 0.6 pip | None | 1:1000 |

| Shares | $10,000 | Market-based | Yes |

None |

Spreads, Fees & Commissions

XM operates with transparent pricing and no hidden fees. Highlights include:

-

Tight spreads starting from 0.6 pips (Ultra Low account)

-

No deposit or withdrawal fees

-

No commissions on Micro, Standard, or Ultra Low accounts

-

Shares account includes standard commission

Keep in mind that spreads may vary based on market conditions and account type.

Trading Platforms

XM offers robust access to:

-

MetaTrader 4 (MT4): For Forex & CFD trading, low-latency execution

-

MetaTrader 5 (MT5): Advanced tools, more asset classes

-

WebTrader: Browser-based access

-

Mobile apps for iOS & Android

These platforms support one-click trading, technical indicators, charting tools, and EAs (expert advisors), suitable for both discretionary and automated traders.

Deposit & Withdrawal Methods

XM supports multiple payment methods for fast and secure transactions:

-

Local bank transfers (in supported regions)

-

Credit/debit cards (Visa, Mastercard)

-

E-wallets: Skrill, Neteller

-

Zero fees on deposits and withdrawals

Withdrawal requests are typically processed within 24 hours, depending on the method used.

Customer Support & Education

XM provides multilingual customer support available 24/5 via:

-

Live chat

-

Email

-

Phone

Their educational resources are among the best in the industry:

-

Free daily webinars

-

Live trading sessions

-

Trading signals

-

Video tutorials

-

Comprehensive knowledge base

-

Unlimited demo accounts for practice

👉 Great starting point for beginners – check out our Forex Basics guide

Who Should Use XM?

XM is ideal for:

-

Beginner traders looking for a safe, low-cost start with full educational support

-

Intermediate traders who want flexibility in platform and account options

-

Experienced traders using MT4/MT5 for Forex, indices, and commodities

Not recommended if you’re primarily looking to trade crypto assets or want proprietary platforms.

Conclusion: Is XM Worth It in 2025?

XM remains a strong, reputable, and regulated forex broker in 2025. With its client-first approach, transparent conditions, and solid infrastructure, XM provides a well-rounded trading experience that caters to both entry-level and seasoned traders.

👉 Looking for a reliable broker with global recognition and flexible conditions? XM may be the right choice.

🔗 Visit XM Official Website

FAQ about XM Broker

Is XM a regulated broker?

Yes. XM is regulated by top-tier authorities including FCA (UK), ASIC (Australia), and CySEC (Cyprus).

What is the minimum deposit at XM?

Just $5 for Micro and Standard accounts.

Does XM offer a demo account?

Yes, XM provides unlimited demo accounts with virtual funds.

Can beginners use XM?

Absolutely. XM’s user-friendly interface, free education, and low cost make it an excellent choice for beginners.