Why Timing Matters in Forex Trading

The forex market operates 24 hours a day, five days a week, offering tremendous opportunities. However, not all trading hours are created equal. Understanding the best hours to trade forex can significantly affect your profitability. Trading at optimal times helps ensure higher liquidity, lower spreads, and increased potential for profit.

Volatility and Liquidity Explained

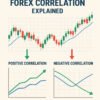

Two critical factors determine the efficiency of trading times: volatility and liquidity. Volatility refers to the frequency and magnitude of price movements, which opens the door for potential profit (or loss). Liquidity refers to how easily a currency pair can be bought or sold without causing significant price movement.

The best trading times combine high volatility and high liquidity, allowing for tighter spreads and more reliable trade execution.

The Role of Time Zones in Forex Markets

The forex market spans the globe and follows the sun. As trading activity shifts from one major financial hub to another—Sydney, Tokyo, London, and New York—volume and volatility change accordingly. The overlap between sessions often presents the best time for currency trading because of the increased market activity.

The 4 Major Forex Trading Sessions

Forex trading can be broken down into four main sessions:

Sydney Session (Asia-Pacific Opening)

- Time (GMT): 10:00 PM – 7:00 AM

- Activity: Low to moderate

- Active pairs: AUD/USD, NZD/USD

This session marks the start of the trading day but generally has lower volume than other sessions.

Tokyo Session (Asian Markets)

- Time (GMT): 12:00 AM – 9:00 AM

- Key characteristics: Steady and predictable

- Active pairs: USD/JPY, EUR/JPY, AUD/JPY

Insight: Japan is one of the biggest players in forex, and the Tokyo session is particularly important for JPY-based currency pairs.

London Session (European Markets)

- Time (GMT): 8:00 AM – 5:00 PM

- Characteristics: Highest liquidity, volatile movements, overlaps with both Tokyo and New York

- Active pairs: EUR/USD, GBP/USD, EUR/GBP, USD/CHF

🔥 Highlight: The London session accounts for about 35% of all forex transactions. This is widely regarded as the best time to trade currencies for most traders.

New York Session (U.S. Markets)

- Time (GMT): 1:00 PM – 10:00 PM

- Highlights: High volatility due to U.S. economic reports and news

- Active pairs: USD/JPY, USD/CAD, GBP/USD

The overlap between the London and New York sessions (1:00 PM – 5:00 PM GMT) is often considered the most active and potentially profitable window.

Best Hours to Trade Forex by Currency Pair

EUR/USD

- Best hours to trade forex: 1:00 PM – 5:00 PM GMT

- Why: Overlap of London and New York, tight spreads, highest liquidity

GBP/JPY

- Best hours: 7:00 AM – 9:00 AM GMT (Tokyo-London overlap)

- Why: Volatility from both Asian and European sessions

AUD/USD

- Best hours: 12:00 AM – 3:00 AM GMT (Sydney-Tokyo overlap)

- Why: Responsive to regional news from Australia and Asia

USD/CAD

- Best time: During New York session (1:00 PM – 5:00 PM GMT)

- Why: North American market open, oil-related volatility (CAD is commodity-linked)

Avoid These Times: When Not to Trade

While it’s technically possible to trade at any time, certain periods are best avoided:

During Low Liquidity Hours

- Example: 9:00 PM – 11:00 PM GMT

- Reason: Most major markets are closed, leading to wider spreads and reduced volatility

Right Before or During Major News Releases

- Example: U.S. Non-Farm Payrolls, central bank decisions

- Risk: Unpredictable spikes, slippage, and execution delays

⚠️ Caution: Only trade during news releases if you have a defined strategy and fast execution tools.

Best Time for Currency Trading Based on Trading Strategy

Different trading strategies align better with specific forex sessions:

Scalping

- Best during: High liquidity hours (London-New York overlap)

- Why: Quick trades need tight spreads and frequent price movements

Day Trading

- Best during: London session and New York open

- Why: These sessions offer consistent movement within the day’s trading range

Swing Trading

- Best during: Major session openings or during trending periods

- Why: Larger price swings occur when multiple sessions overlap

News Trading

- Best during: Scheduled economic events

- Why: Volatile reactions offer big opportunities, though high risk

Tools to Help You Trade at the Best Times

Economic Calendar

Track high-impact news with tools like:

Time Zone Converters

Avoid confusion by syncing your time with GMT or using tools like:

Broker Trading Hours

Always double-check your broker’s actual trading hours and server time to avoid placing trades when markets are illiquid.

⭐ Pro Tip: Set alerts for ideal trading windows and use stop-loss orders for risk control.

Summary: What’s the Best Time to Trade Forex?

| Session Overlap | Time (GMT) | Benefits |

| London–New York | 1:00 PM – 5:00 PM | Best time for most pairs due to liquidity and volatility |

| Tokyo–London | 7:00 AM – 9:00 AM | Great for JPY and GBP pairs |

| Sydney–Tokyo | 12:00 AM – 3:00 AM | Best for AUD and NZD pairs |

📌 Key takeaway: Trading during major session overlaps is your best chance to capitalize on market movement and reduce slippage.

Frequently Asked Questions (FAQs)

What is the best time to trade forex in my time zone?

Convert GMT to your local time. For example, if you’re in Vietnam (GMT+7), the London–New York overlap is from 8:00 PM – 12:00 AM local time.

Are weekends good for trading forex?

No. The market closes Friday 10:00 PM GMT and reopens Sunday 10:00 PM GMT. No trading activity occurs during this period.

Does trading at night affect results?

It depends on your location. Nighttime trading in your local time may coincide with an active session globally. Always refer to global session overlaps.

What time should beginners trade forex?

Stick to the London and New York sessions when spreads are tighter and movement is more predictable. Avoid news releases until you’re more experienced.